Digital banking boom during coronavirus pandemic: How will it affect e-wallets’ demand in Germany?

via Silicon Canal

The increase in the digitalisation of banking services via apps heralds an upcoming transformation in the fintech industry. A recent study by global financial comparison platform Finder.com shows that within the next five years, which is by 2025, around 27.8 million German adults are expected to have online-only bank accounts.

Which means digital banks are set to boom in Germany, with 40% of adults expected to have an account by 2025. Finder’s survey of 1,509 German adults conducted in March reveals 28%, or an estimated 19.7 million people, currently have an online-only bank account. With 12% planning to open an account in the next 5 years, that means the number of neobank account holders could balloon to around 27.8 million as soon as 2025.

Global fintech editor at Finder, Elizabeth Barry, says the novel coronavirus pandemic could act as a catalyst for digital banking adoption. “Restricted movement means that what was once forecasted for the next five years could be squeezed into a much shorter time frame,” Barry says.

“However it’s possible that reduced spending and low consumer confidence could actually eat into challenger banks growth rate. It’s not clear yet whether the coronavirus will help or hinder neobanking adoption.”

Online banking has become a preferable option due to the high level of convenience it has to offer. Also, it is secure and accessible at any given time. Eventually, these convenient factors have paved the way for a digital revolution in the banking industry. Having said that, today we take a look at the most popular digital banks/apps in Germany in 2020.

Picture credits: N26

N26 (Germany)

Founder/s: Maximilian Tayenthal, Valentin Stalf

Founded year: 2013

Funding: €621 million

N26 lets opening an account possible in as quickly as 5 minutes directly from your smartphone sans waiting in long lines and filling complicated paperwork. What’s more interesting is that there is no need to maintain any minimum balance and there isn’t any maintenance charges or foreign transaction fees. N26 will send instant notifications regarding all account activities such as withdrawals, payments, and deposits. On referring a friend, you will get a cash bonus as well.

Picture credits: bunq

bunq (Netherlands)

Founder/s: Ali Niknam

Founded year: 2012

Funding: €44.9 million

bunq is a fully operational mobile bank that is accessible via your smartphone. You can create a bunq account from your phone in just 5 minutes. Recently, Amsterdam-based bunq made opening joint accounts easier with the launch of bunq +1, which lets users create a joint account with their partners, employees or children. All the bunq +1 account holders will get their own card and will be able to view transactions and deposit money.

Picture credits: Revolut

Revolut (UK)

Founder/s: Nikolay Storonsky, Vlad Yatsenko

Founded year: 2015

Funding: €763 million

London-based digital bank Revolut is a well-known service in the industry. It operates with the mission to build an open and frictionless platform to use and manage money. The fintech startup offers a prepaid debit card, peer-to-peer payments, and currency exchange among other features. Earlier this year, Revolut came up with a new called Revolut Junior, which teaches kids basic financial skills that are needed for their life.

Picture credits: Tomorrow

Tomorrow (Germany)

Founder/s: Jakob Berndt, Michael Schweikart, Inas Nureldin

Founded year: 2017

Funding: €8.5 million

With Tomorrow, you will be able to open an account in just 10 minutes using your smartphone without any paperwork and formal hurdles. This digital banking service lets you do everything that you need to manage your account such as change the PIN and smart features. It also sends push notifications for all transactions and provides you an insight into your account at any given time. What’s more interesting is that the Tomorrow account does not require you to pay any charges.

Picture credits: insha

insha (Germany)

Founder/s: Meliksah Utku

Founded year: 2018

Funding: NA

Germany-based insha is a digital banking service that offers eco-friendly and sustainable solutions as it doesn’t involve any paperwork. All correspondence and transactions are managed online. The insha banking app is user-friendly and has a slew of practical features such as the ability to reset spending limits on your debit card. It also sends real-time notifications about account-related activities. You can open an insha account in just 10 minutes and the debit card will be shipped to your postal address.

Picture credits: neon

neon (Switzerland)

Founder/s: Jörg Sandrock, Simon Youssef, Julius Kirscheneder, Michael Noorlander

Founded year: 2017

Funding: €4.2 million

Zurich-based neon lets you open a bank account and manage your debit card and account via an app. The digital banking service will help you keep track of your everyday finances. There is no base fees and the service provides you with a free Mastercard as well. Open a neon bank account in less than 10 minutes and manage your finances in just a few clicks with the neon banking app.

Picture credits: Monese

Monese (UK)

Founder/s: Norris Koppel

Founded year: 2013

Funding: €73.1 million

Monese reimagines banking services by creating financial freedom for its users and letting them easily manage their money from anywhere and anytime. Monese’s technology can validate the identity of customers in real-time enabling customers to open an account in a matter of minutes, using a mobile app. Monese’s fully-featured UK banking account comes with cheap global payments and a contactless debit card.

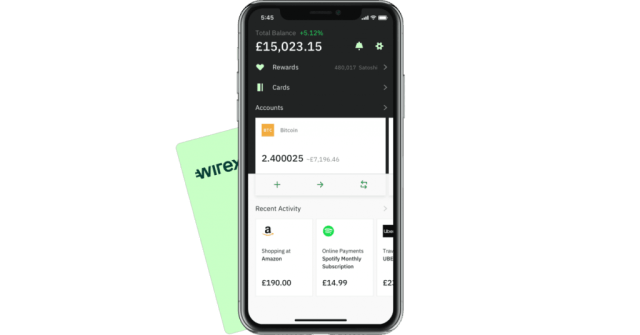

Picture credits Wirex

Wirex (UK)

Founder/s: Dmitry Lazarichev, Pavel Matveev

Founded year: 2014

Funding: €3 million

Wirex is an FCA-licensed global digital money solutions provider for businesses and individuals. It offers the first borderless payment platform to integrate both cryptocurrency and traditional money transfer and exchange services. The service is built using state-of-the-art technology, which integrates traditional currency and cryptocurrency. Wirex is PCI DSS Level 1-certified, giving your funds the highest level of protection possible.

Picture credits: Qonto

Qonto (France)

Founder/s: Alexandre Prot, Steve Anavi

Founded year: 2016

Funding: €136 million

Qonto is a neobank for freelancers and SMEs. It provides great customer support, transparency, and connection to carry out day-to-day business management. Qonto’s versatile design adapts to all types of companies, for any legal form or team size. Qonto provides all the necessary tools to master the finances of an organisation. It is designed to make to simple to manage all transfers, debits, card payments, and small details.

Picture credits: VIALET

VIALET (Latvia)

Founder/s: Artjoms Grivkovs

Founded year: 2017

Funding: NA

VIALET provides users with the financial service management tool that they always deserve. Without any unnecessary bank visits, you will be able to experience your complete power with this startup. It lets you be in charge of your finances. You can manage your own VIALET Mastercard, open an account, manage finances, and transfer funds at anywhere and anytime.

Picture credits: norisbank

Norisbank (Germany)

Founder/s: NA

Founded year: 1954

Funding: NA

norisbank is a strong and successful brand in the banking industry in Germany with a presence of over five decades. Adapting the modern technologies that make lives of its customers more comfortable, norisbank has come up with digital banking services that will provide more flexibility, convenience and service at anytime. Users can just manage their account online and get all the insights into their finances.

Picture credits: Bitwala

Bitwala (Germany)

Founder/s: Benjamin Jones, Jan Goslicki, Jorg von Minckwitz

Founded year: 2015

Funding: €19.4 million

Bitwala is the service that built the world’s first account to offer customers a regular bank account, a bitcoin wallet and trading integrated into a single platform. Eventually, it is possible to buy and sell bitcoin and ether directly from your bank account. Bitwala lets you open an online bank account in just five minutes and does not require any maintenance charges. The cryptocurrency trading charges is only 1% and ensures instant liquidity.